The Technology Investment Boost provides small & medium business with a 20% BONUS tax deduction for eligible expenditure incurred for the purposes of a business’s digital operations or digitising the business operations. This means you can claim 100% of the original cost PLUS the additional 20% Bonus tax deduction.

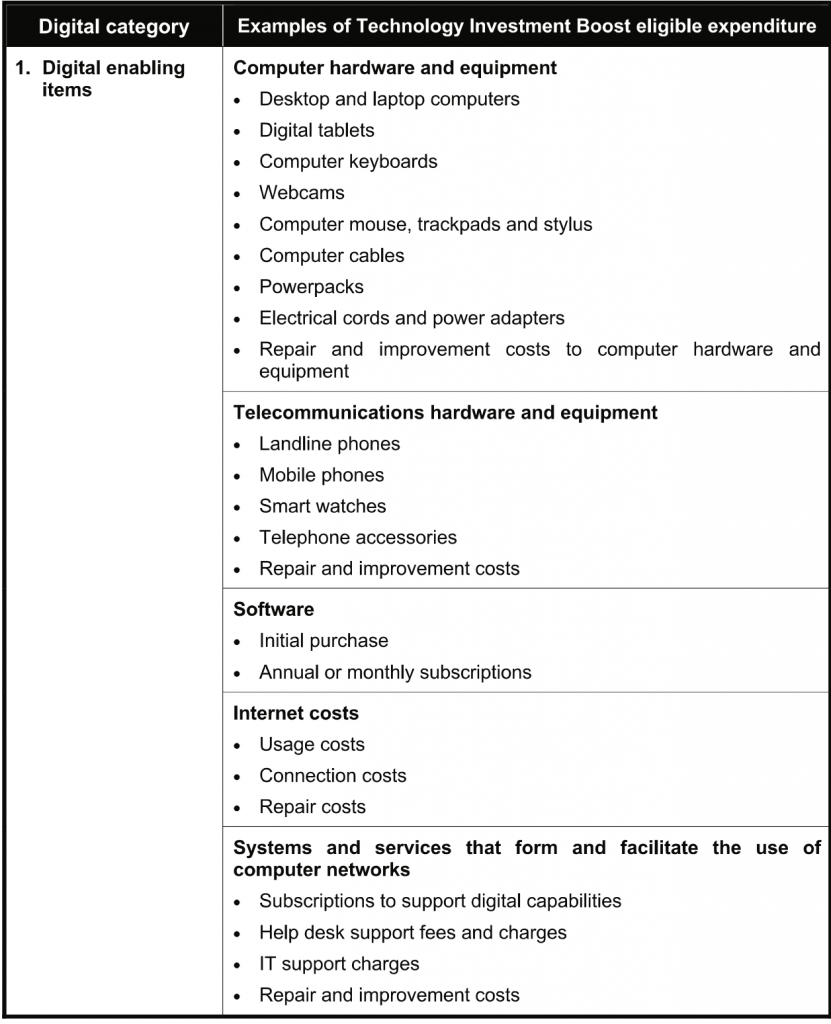

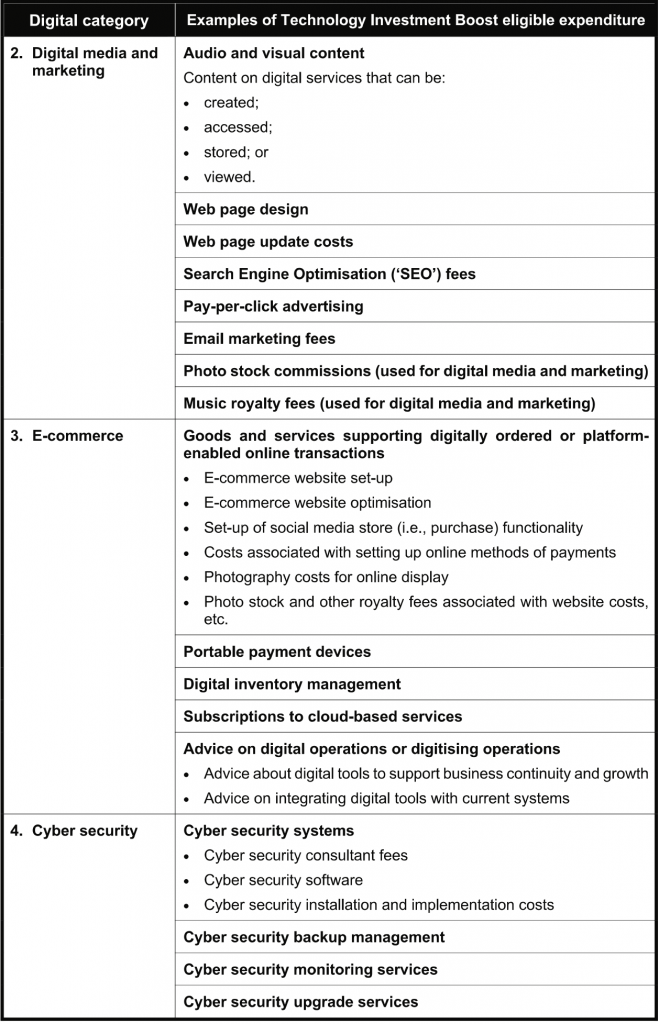

1.3.2 Common examples of expenditure that may be eligible for the Technology Invent Boost. To be eligible for the bonus deduction, the expenditure itemised below must be incurred wholly or substantially for the purpose of an entity digital operations or digitising the entity’s operations.